Share Certificates

When you’re looking for a share certificate in Florida, Suncoast has you covered! A share certificate is like a certificate of deposit (CD) offered by banks, but with all the money-saving benefits of a credit union.

Discover the Right Certificate for You

Select an option below to open a certificate account with:

Explore the Benefits of Suncoast Share Certificates

Share Certificate Calculator

PRODUCT NAME remove from calculation add to calculation

You

Save

an additional

i

$

00

Congratulations, you already have a great rate! Click to learn more about our services and to see how we can help you save.

Share Certificates Rates

Blog Articles For You

Get inspired, informed and empowered with these personalized articles just for you.

Good For You. Good For The Community.

Whether you’re banking on the go or giving back Suncoast makes it simple for you.

Giving Back is in our DNA!

A swipe, tap or click from your Suncoast debit or credit card supports our local communities through the Suncoast Credit Union Foundation.

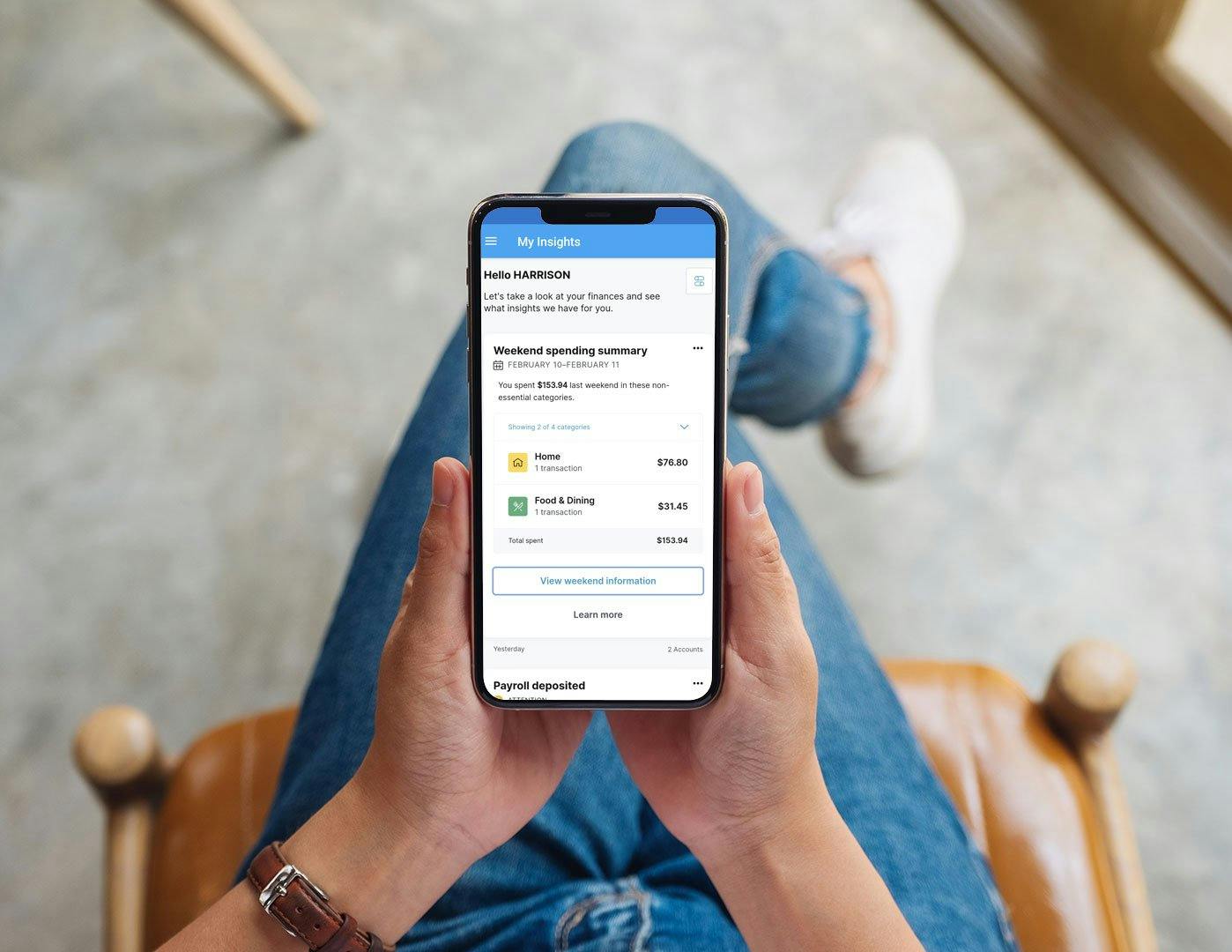

Download the SunMobile App

Our SunMobile app lets you manage your finances quickly, safely and securely from the convenience of your smartphone or tablet.