Plan and Retire

What’s an IRA?

January 25, 2018

If one thing’s for sure, the financial industry loves acronyms! From APRs to IRAs, it can get confusing to manage your finances when you’re just trying to figure out what everything means. We get it!

IRA stands for individual retirement account or individual retirement arrangement. Before we go into more detail about what IRAs are and how they work, let’s start with the important question: why is this important to you?

How IRAs Can Help You

IRAs can help you save money for retirement. Even if retirement isn’t on your radar yet or you think you don’t have enough to save, please keep reading!

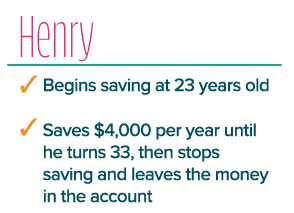

Putting off saving might not seem like a big deal, but it can make a major impact on how much money you end up with. Here’s an example of how a 10-year difference in start times can lead to a drastic difference in savings.

In this example*, Henry only saved for 10 years while Greg saved for 32 years. Henry also invested less money over time than Greg did. If both of their accounts had an 8% annual return, guess who would have more money by age 65?

Henry’s 10 years of investments would equal $734,530 while Greg’s 32 years of investments would come to $579,802. That means even though he put in less money total over a shorter period of time, Henry ended up with more simply from starting sooner.

It’s never too late to begin saving for retirement. But the sooner you begin, the more you can accumulate in the long run.

Now that you’ve seen how much of a difference these savings can make over time, let’s cover some of the different kinds of IRAs and the benefits of each.

What’s a Traditional IRA?

A Traditional IRA is a retirement savings account that offers tax advantages. The money you contribute to a Traditional IRA could be fully or partially tax-deductible. Typically, the funds you contribute to a Traditional IRA aren’t taxed until you withdraw them.

Requirements and Annual Limits for a Traditional IRA:

- Eligible compensation is needed (usually earned income)

- Annual contribution limits are $5,500 as of 2018 for people 49 years old or younger

- Annual contribution limits are $6,500 as of 2018 for people 50 years old or older

- Your total contributions to all your Traditional and Roth IRA contributions combined cannot exceed this limit

IRA contribution limits don’t apply to rollover contributions or qualified reservist repayments.

Benefits of a Traditional IRA

As long as you keep your money in an IRA, you won’t pay taxes on any interest on your contributions. This makes it easy to accrue interest and grow your savings.

Other benefits include:

- Earnings are tax-deferred until you withdraw them

- You can enroll in a Traditional IRA on your own without employer participation

- Investment options are flexible

- Your assets are easily accessible

- Tax deduction can happen immediately when you contribute, when eligible

- You may get a tax credit, when eligible

What’s a Roth IRA?

Like a Traditional IRA, a Roth IRA is a retirement savings account with tax advantages. There are no age limits for Roth IRAs, but there are defined limits for eligible compensation.

These limits could depend on cost-of-living adjustments and your tax filing status. As of 2018, you cannot contribute to a Roth IRA if you’re single and your modified adjusted gross income is more than $135,000 a year, or if you’re married with a joint tax return that has a modified adjusted gross income of more than $199,000 a year.

Requirements and Annual Limits for a Roth IRA:

- Eligible compensation must fall within or below the defined limits

- Annual contribution limits are $5,500 as of 2018 for people 49 years old or younger

- Annual contribution limits are $6,500 as of 2018 for people 50 years old or older

- Your total contributions to all your Traditional and Roth IRA contributions combined cannot exceed this limit

Benefits of a Roth IRA

Roth IRAs accumulate earnings over time and can lead to long-term savings.

Other benefits include:

- Earnings are tax-deferred until you withdraw them

- You can enroll in a Roth IRA on your own without employer participation

- Investment options are flexible

- Your assets are easily accessible

- Distributions are tax-free, when eligible

- You may get a tax credit, when eligible

- No minimum distributions requirements during your lifetime

No matter what type of retirement savings you choose, now is the time to get started!

For more information on retirement saving options and services, check out our retirement planning resources.

* This material is for illustrative purposes only and not intended to depict or predict the performance of any specific investment. This example does not reflect the impact of taxes, transaction costs or other fees generally associated with investing.

Category

Plan and Retire

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida