Budget and Save

3 Tips to Get Kids Excited about Saving Money

May 10, 2017

Have you ever heard of the “Marshmallow Test?” It’s a study about willpower that was created back in the late 1960s that people still try to this day, with more than a million search results on YouTube.

Basically, an adult leaves a child alone with a marshmallow (or other treat) and the child can either eat the marshmallow immediately or wait for the adult to return and get two marshmallows to enjoy.

As an adult, it seems obvious that waiting a little longer for twice the reward is well worth it. But for a child, the instant gratification can be very tempting despite the smaller reward. This is one of the reasons why saving does not always come naturally to children.

Money management is a crucial life skill and the earlier a child masters it, the better. It can even be a lot of fun to learn smart saving habits!

Here are some tips that can help get the kids in your life excited about saving money:

Create Special Savings Crafts

Art projects make everything more fun, so break out the markers, paint or glitter to help get your kids excited about saving money!

Help your kids create their own bank or let them decorate an existing one with stickers or other art supplies. This special place to hold their savings will help create a sense of ownership and pride every time your child adds money to the bank.

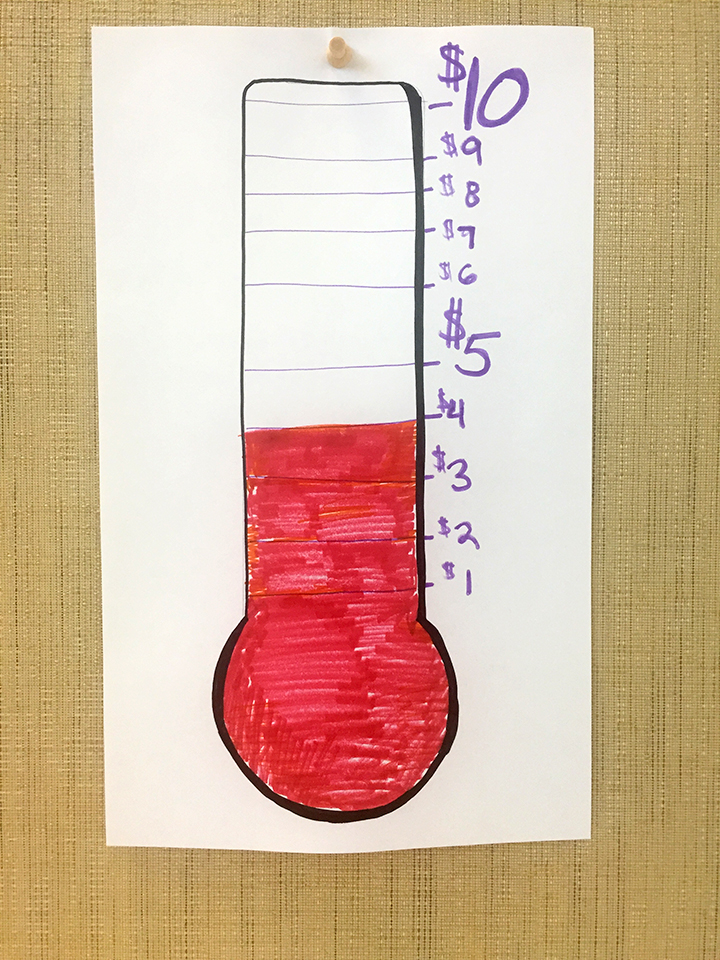

A visual aid can also foster excitement about getting closer to a savings goal. Think of those thermometer-style visuals where the goal amount is at the top and you color in the chart as you get closer to the goal. Your child’s chart doesn’t have to look like this, but it should have a similar effect of making it easy to tell at a glance how close you are to the goal.

Depending on the age of the child, these charts can be made simple or more complex. For example, a young child that wants to save $10 for a small toy could have a chart where each sticker represents $1. This makes it easy for the child to check on progress with the goal of getting 10 stickers on the chart.

Match Their Savings

Another way to encourage kids to want to save money is by matching their savings. You can customize this idea to meet your needs based on the age and goals of your children.

You could do an exact match of each dollar they put into savings or a system that matches once they reach a certain amount of money. You could also create match-based incentives when your child makes a good financial decision. For example, every time your child puts allowance money into savings instead of spending it, you will match the amount that they save.

Not only will this help them reach their financial goals faster, but it will also encourage them to participate in employer match contributions later in life.

Use Rewards or Want Lists to Teach Longer-Term Saving

One of the trickier elements to teach a child is that just because you want something now doesn’t mean you will want it as much later. Much like the marshmallow test, it’s hard for some kids to care as much about the longer-term goals when faced with immediate wants.

There are different strategies to teach this, depending on the age of the child. For toddlers or preschoolers, you can introduce this concept with a simple points and rewards system.

Create a point system for watching videos, TV or movies where the longer the video, the more points it “costs.” Your little ones can earn points based on good behavior or putting away their toys, and then cash the points in for screen time.

For example:

- Online video under 15 mins: one point

- TV episode under 30 mins: five points

- Entire movie: 10 points

You can track the points with a simple sticker chart or make little coupons. The idea is that over time, your child will learn to save up points in order to watch “Frozen” for the millionth time.

For older kids and teens, you can introduce a “want list” to teach them how to save for larger items. When they want an item that is more expensive, they put it on their want list with today’s date listed next to it.

Before your child buys the time, it has to stay on the want list for a specific amount of time, like 6 weeks. This means even if your child can afford the item now, they have to wait before purchasing it.

Before the 6 weeks are up, your child will likely have other things added to the list. They may know want these other things more than first thing. This will make them stop and think before spending their money on an immediate want.

Start Saving with a Suncoast Youth Account. We’re here to help members of all ages develop healthy savings habits.

Category

Budget and Save

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida