Buy and Borrow

Student Loan 101: How to Borrow Responsibly

June 18, 2018

It’s no secret, college is expensive. If you or your child is getting ready to begin the college journey, how to best pay for it is probably on your mind.

Here are some simple strategies to fund college with responsible borrowing habits.

Why Invest in a College Education?

College costs are scary for many potential students and their families. Though the price can be high, college is an investment in the future.

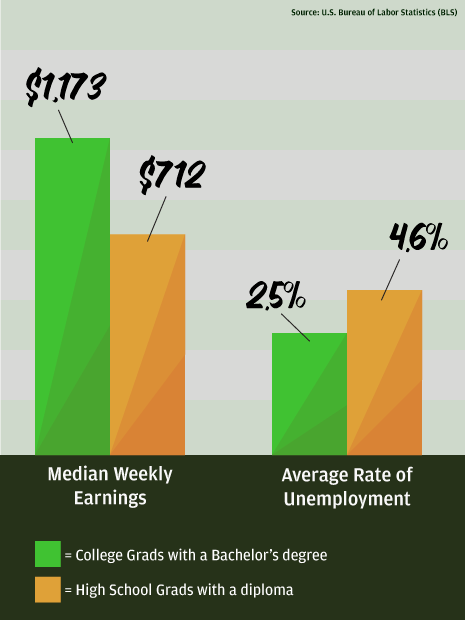

Aside from the knowledge you’ll gain, the experiences you’ll have and the professional skills you’ll learn, a college education can help set you up for long-term success. College graduates often make more money and have lower unemployment rates than high school graduates.

Start with Savings, Grants, Scholarships and Federal Aid

Before you begin borrowing money for college, you want to exhaust all of your other options. If you have college savings, use that first. If not, apply for all of the grants and scholarships you can.

You may be surprised by how much money you can earn through grants and scholarships! There are so many options, so apply to as many as possible. And keep applying throughout your college career to help offset some of the costs as you go.

Next, apply for federal aid to see what you may qualify for. Depending on what criteria you meet, you may be able to get federal grants that you don’t have to pay back.

A college graduate with a Bachelor’s degree earned a median wage of $1,173 per week in 2017. The median weekly earnings for someone with a high school diploma during that time was $712. College graduates had lower unemployment rates (2.5% for Bachelor’s degree holders) than high school graduates (4.6%). SOURCE: U.S. Bureau of Labor Statistics (BLS).

Apply for Federal Student Loans First

If you still need funding after you’ve applied for federal aid, it’s time to consider student loans. Starting with federal student loans is most common, as they often come with benefits that private loans do not.

Federal student loans don’t require you to begin paying until you graduate, leave college or begin going to school less than half-time.

Federal loans tend to have lower, fixed interest rates and students with financial need may qualify for subsidized loans where the government takes care of the interest on the loan while you attend school.

Other benefits of federal loans may include loan forgiveness options and the possibility of deferring payment for a period of time.

Consider Private Student Loans Next

Even after federal loans, you may need additional loans to finish paying for college. Private loans can help cover these costs.

Every private lender will have its own set of requirements for student loans. They will also offer their own interest rates, repayment options and potential fees.

To find the private loan that is right for you, take time to understand what your needs are and which loan meets those needs.

Understand Student Loans before Applying

Before applying for any type of loan, it’s important to understand what you’re signing up for. Consider things such as:

- Is the interest rate fixed or variable?

- What are the terms of the loan?

- What are the repayment options?

- What fees are associated with the loan?

- What is the minimum or maximum you can borrow for the specific loan?

- How much does the student expect to earn in the future?

While you research these things, think about how the answers would impact you. For example, many private student loans require payment as you attend school rather than after graduation. Though this may seem difficult, it could also be helpful to begin paying loans sooner because it means that you may graduate with less debt.

College can change your life or your child’s life for the better. So don’t stress, just practice responsible borrowing!

Student Loan Options from Suncoast - Learn more about our undergraduate and graduate school loan options.

Category

Buy and Borrow

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida