Buy and Borrow

Benefits of Buying a Home (Infographic)

May 07, 2018

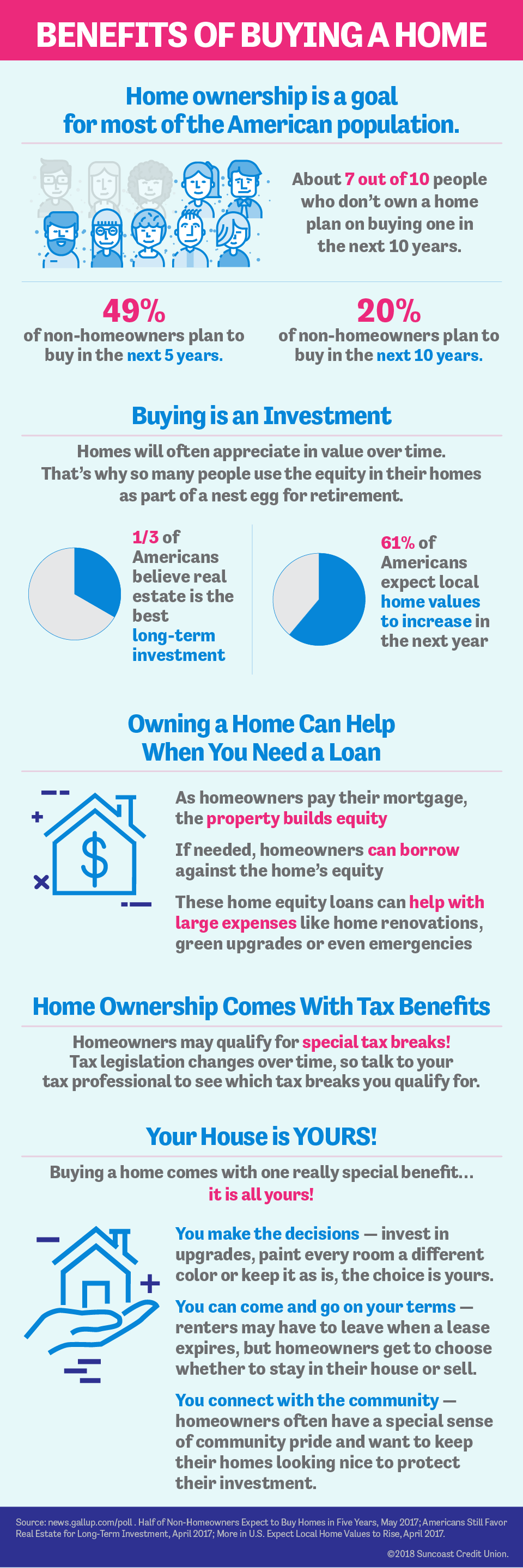

Buying a home is a life-changing experience, especially for first-time home buyers. Home ownership comes with benefits that can impact your day-to-day life and your long-term future.

From tax benefits to appreciating value, learn about the unique benefits of buying a home in our infographic. And if you’re ready to start looking, we can help you find, finance and protect your home!

Sources:

news.gallup.com/poll/210008/half-non-homeowners-expect-buy-homes-five-years.aspx

news.gallup.com/poll/208820/americans-favor-real-estate-long-term-investment.aspx

news.gallup.com/poll/208901/expect-local-home-values-rise.aspx

Category

Buy and Borrow

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida